How to Protect Yourself from Identity Theft - 10 Things You Should Do

Keep Yourself Safe from Identity Theft

ALL TOPICS

- YouTube Parental Control

-

- How to see your YouTube history?

- What is Metaverse? Parent Guide

- Put parental controls on YouTube

- Delete TikTok Account without Phone Number

- Ways to block YouTube channels

- Ways to Get Somone's IP Address and Hide IP Address

- A complete guide on YouTube parental control

- What is Fanfiction? Parents Guide

- Kids safe YouTube alternative

- Top 5 TikTok Alternatives

- Methods to restrict YouTube adult content

- Social Media App Parental Controls

- Parental Control Tips

Sep 11, 2024 Filed to: Parent's Guide Proven solutions

Identity theft is a crime that involves obtaining someone's financial or personal identifying information without their permission and use it to commit fraud. Essentially, this can include making unauthorized purchases and transactions. With that in mind, let's look at the damages it can cause and how to protect yourself from identity theft.

What Troubles Will Identity Theft Bring To Our Daily Life?

Identity theft can impact you negatively in the following ways:

- Socially

These days, many people spend most of their time on the internet. Some have good intentions, while others have bad intentions. Hackers can access your personal information like social media passwords. They can use this information to damage your reputation on social media and create new fake accounts in your name.

- Leads To Physical Stress

Recent studies reveal that 41 percent of identity theft victims may experience sleep disturbance. Additionally, 29 percent of identity theft victims develop physical symptoms such as sweating, heart palpitations, aches and pains, and aches and pains. Lastly, 40 % of identity theft victims are afraid of their physical safety and unable to focus on their daily life activities.

- Mentally

Identity theft can result in a host of mental issues. For instance, anger is the first feeling that an identity theft victim will experience. While you can overcome and recover from anger issues, you could develop other challenging and long-term mental issues due to identity theft. When someone steals your identity and commits a crime in your name, this can damage your reputation. Fixing your reputation can be stressful, especially when you are applying for a job. It gets worse? When the interviewing panel decides to run a background check on you, this could lead to your arrest.

- Economically

Identity theft can cause you major monetary sufferings that can affect you for several years to come when identity thieves access your financial data. After taking over your account, identity thieves can take over all your investments and financial accounts. Consequently, this could affect your career, retirement plans, child’s education, and mortgage. So learning how to protect yourself from identity theft can be beneficial.

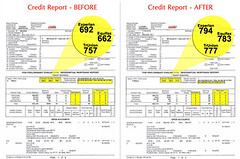

- Leave You with a Bad Credit History

When an identity thief tries to steal your social security number and proceeds to open a new bank account using your details, this may leave you with a poor credit score. This not only prevents lenders from giving you loans but it can also damage your reputation at work.

- Tax Debt

Fraudsters can assume your identity through your Social Security Number on job applications. Because they won't pay taxes, you may end up with a huge bill. They can also file a return in your name and submit erroneous information so that they can get a refund. They will then leave you to deal with the consequence.

- Leave You with a Criminal Record

If someone uses your identifying information to commit fraud or other criminal activities, you may end up getting mixed up in the situation since the police will use your details as evidence against you.

10 Things You Should Do To Prevent Identity Theft

There are several things you can do to prevent yourself from being a victim of identity theft. You need to be on the lookout at all times and know how to protect yourself from identity theft to avoid becoming a victim. That said, below are ten things you should always do to prevent identity theft.

- Set a Fraud Alert on Your Credit Card

Fraud alerts play a major role in hindering thieves from accessing your accounts. Whenever an identity thief tries to access your account using your details, your partner will receive a fraud alert to confirm your identity before proceeding with the application. Here's the deal: You can place a fraud alert for free on your credit report for a period of up to 7 years at no cost.

- Credit Monitoring

Credit monitoring can help you prevent identity theft as it provides notifications when someone accesses or updates your credit report. Therefore, if you are a victim of identity theft, you might want to use credit monitoring services to avoid repeat attacks.

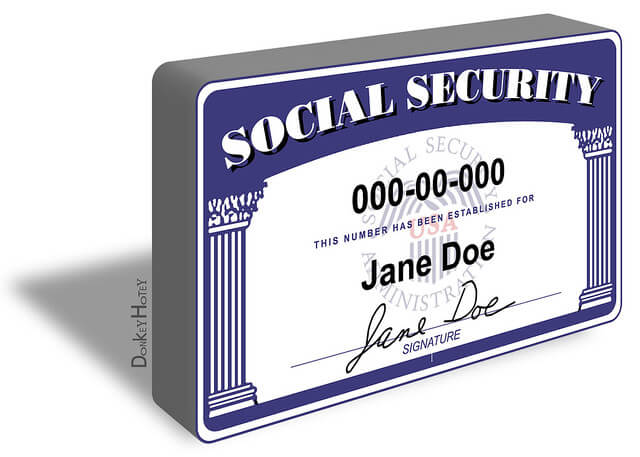

- Secure Your Social Security Number

Always keep your Social Security Number safe from the wrong hands. The best decisions to make is to avoid carrying your social security card in your wallet, don't use your SSN on unsecured websites, and never send it via an electronic device. Never type your SSN into an instant message or email and send it; someone can intercept the email message and read it while it's in transmission.

- Change Your Passwords Regularly

When creating passwords for your various online accounts, be sure to use a combination that identity thieves cannot easily guess. That means you should avoid using combinations like '1233456' and your mother's, spouse's, or kids' name.

- Always Be Careful When Traveling

Whenever you are about to travel, leave your Social Security Card or other important items in a safe place. If you decide to carry a mobile device, ensure it is secure and password protected at all times. Most importantly, always check to ensure the internet cables or Wi-Fi spots are secured and recommended before accessing them.

- Use Digital Wallets

In case you are paying online, always opt for a digital wallet. A digital wallet is an application that contains digital versions of credit and debit cards. Want to know the best part? Online digital transactions are tokenized and encrypted, making them safe from identity theft.

- Avoid Email Phishing Scams

Email fishing refers to bogus emails that may appear to be real. Such mails can claim that they came from banks, credit institutions, and even the IRS. Whenever you receive any confirmation e-mail regarding your account, do not respond to it. Delete it immediately or report the sender. Opening such mails will only expose you to identity thefts, which will have adverse effects on you.

- Collect Mail Frequently

Identity theft criminals have come up with new methods of stealing your identity. By taking your credit card or bank statements, thieves can reroute your mail by submitting a change of address request in your name. Develop the habit of tracking any mail that hasn't arrived and put your mails on hold when you are away.

- Keep Spyware Software Up-To-Date

Does your spyware keep prompting you to update the software? Whenever you see such prompts, don't click on them. Such prompts may consist of links to viruses or spyware that may destroy your device or may display your details to the wrong people.

- Review Your Credit Card and Bank Statements

You need to review your credit card and bank statements. Someone who knows your credit card number or bank details can make small changes and get away with it without you noticing. Check and analyze your statement cycles at all times. Follow up with the financial institutions if you don't receive statements on time.

Will Identity Theft Happen To My Teenager?

Yes, identity theft can happen to any teenager; teenagers cannot tell the difference between good and bad. It can get worse: Your kid could give their identifying information to fraudsters on the internet unknowingly. What can parents do to protect their kids from identity theft?

Use Famisafe To Keep Track of Your Kids' Online Activities

In this digital age, the main goal of parents is to keep their kids safe. That's where FamiSafe comes in: the app has useful features designed to protect your kids from becoming victims of identity theft. They include:

- App Blocker

Children can't evaluate trustworthy apps and they can unknowingly infect their mobile device. Using FamiSafe's app blocking feature allows you to monitor their device and know when they have installed an app on their phone or tablet. If your kid installs harmful apps on their mobile device, you can block them and they won't be able to use them.

- Web Filtering

FamiSafe comes with a powerful filtering tool that prevents your kid from accessing unauthorized sites that are potentially dangerous. The app sends you an alert whenever your kid visits a malicious website that may have identity thieves or explicit content.

- Monitor Browsing History

The app also allows you to check the browser history on your children's devices. As such, you can know which sites they visited and block any dangerous website.

- Monitor Suspicious Texts

You can also add suspicious keywords and the app will send you notifications whenever your kid receives suspicious messages on their devices.

- Monitor Your Children's Social Media Accounts

FamiSafe allows you to monitor your kids' social media accounts. By allowing you to monitor your children's internet activity, FamiSafe can help you to ensure that they don't give out sensitive information that someone can use to create credit card accounts and other fraudulent activities.

- Location Tracking & Geo-fencing

- App Blocker

- Web Filtering

- Screen Time Control

- Smart Parental Control Setting

Now that you know how to protect yourself from identity theft, you should get FamiSafe to ensure your kid is safe on the internet. Don't let your kid be a victim of identity theft; use these tips to protect them.

Ankhi Bhattacharya

contributor Editor